Positive or negative, short or long term - how does one assess the covid effect accurately?

maconda News January 2021

High double-digit sales growth on the one hand, painful losses on the other. covid has strongly fuelled demand in some sectors, while in others it has come to a complete standstill. Who are the winners and losers and why? How sustainable are the covid effects? And how can this be accurately determined within the framework of a commercial due diligence? maconda shares its experiences of the last few months and provides insights into the special challenges and analysis aspects that become more important in times of covid.

If we look at the figures for this financial year in relation to the previous year for the companies maconda was involved with in 2020, we can quickly and easily determine the current winners and losers of the covid crisis. Highly attractive growth rates are sometimes offset by heavy losses. But the picture that this purely numerical observation shows is merely a snapshot. Attempts to draw conclusions about future business development from historical data have seldom been as inappropriate as they are at present and quickly come to nothing.

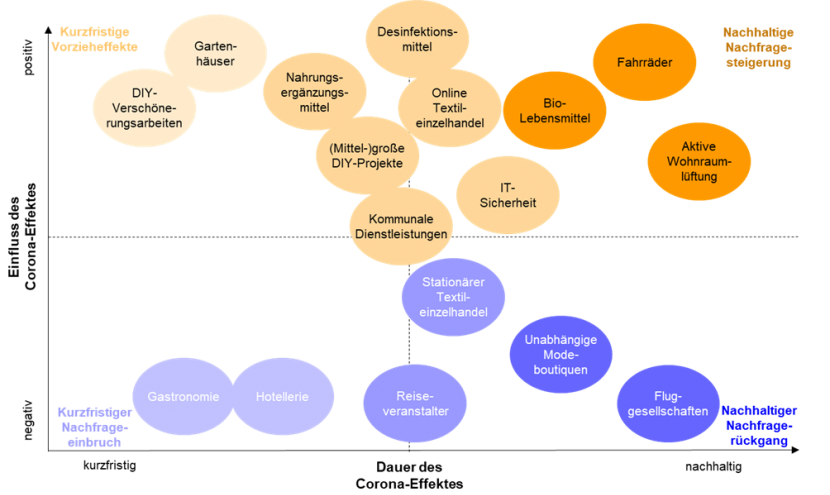

In order to be able to comprehensively assess which industry is only experiencing a short-term boom or slump and which is more likely to be affected in the long term, the dimension of sustainability of the “covid effect” must be added to the snapshot. Companies that appear promising at first glance become less attractive and vice versa. Frankly speaking, to work out these differences is the primary work of a professional provider of commercial due diligence. But nevertheless, it seems to be true that careful strategic due diligence has rarely been as important as it is under the current uncertain circumstances.

Distinguish short-term highs from long-term developments

In recent months, maconda has primarily focused on covid winners. This is not entirely surprising, as external upwinds are often used for M&A processes – after all, the KPIs and thus ultimately the valuation are driven up. But it is equally unsurprising that such covid winners (mostly) acknowledge the external effect in principle, but like to play down its strength. Of course, the growth is not thanks to covid and the performance plus achieved in 2020 is sustainable, of course.

Central to almost every audit was the question: how much of the strong growth is due to the company itself and how much to covid? And how sustainable is the increase in turnover and margin?

Garden sheds and products for minor beautification (wall paint, wallpaper, furnishings) are examples of rather short-term covid winners for us. Due to the increased time spent in the house and garden, there was a massive increase in demand here. However, these are largely pull-forward effects. The number of properties with gardens is constant and garden owners who bought a garden house this year are less likely to buy a new one, or even a second one, in the next 15 years. The renovation cycles for smaller home improvements are around six years. Due to the high orders in 2020, there is no corresponding demand in 2021 and the following years.

Bicycles and organic food, on the other hand, are among the sustainable covid winners. There were also pull-forward effects for bicycles, especially in the fast-growing e-bike segment. Primarily, however, existing fundamental market drivers were strengthened in the aforementioned sectors. The avoidance of public transport and the increased number of domestic holidays accelerated the rediscovery of the bicycle as a serious alternative to the car, supported by the megatrends of environmental and health awareness. And those who have ridden their new e-bike to the office, instead of taking crowded buses, trams and trains, do not completely abandon it even after covid, but buy a new, more expensive e-bike after three years and even inspire others with their rides through the city.

What about organic food? The already high demand for organic quality food in the retail sector and the change in consumer behaviour towards sustainable food have been further accelerated by the closure of restaurants and the increase in cooking at home. All of this will lead to growth rates above pre-covid levels in the medium term.

Special challenges for the analysis:

- Uncertain future pandemic outbreaks and business development, uncertainty in general

- Performance during the covid crisis and current trading are not comparable / reliable / meaningful, no comparative values

- Examine the real reasons for a decline in performance: covid-related negative influences vs. pre-covid difficulties

- Vulnerable business planning and uncertain forecasting

- Difficult to compare directly with peers, especially in niche sectors with thin or missing current figures

- More hypothesis-based and less data-based work

- Factual uselessness of studies and surveys carried out before covid, in a “linear world”

- Need for really good interviews, where the interviewees do not just recite what they have just read in the trade media – quality before quantity.

- Limited access to management through more telephone/video conferencing instead of face-to-face meetings

The necessary tools of a CDD consultant in covid times

The challenges for analysis that covid brings are diverse, but manageable.

So how does a CDD consultant deal with the many factors of uncertainty? The low reliability of current performance figures makes it necessary to calculate scenarios when validating the business plan and estimating the development of the relevant market. To normalise the covid effect, the optimal starting point for the projected future development should also be found. Citing “large” studies in CDDs? If one is honest, this is no longer possible. In any case, the relevance for forecasting is severely limited.

In many cases, however, especially in niche markets, purely data-based analysis remains difficult and hypotheses fed by broad market soundings become all the more important. Whether structured surveys of consumers and customers or explorative conversations with industry insiders, associations or competitors, interviews with various market participants then serve as a central source of information and are an important basis for the assessment.

The experience of the last year shows that some sectors are advancing during the crisis, and not just through a one-off run-up. Sustainability can certainly be determined, even without the famous crystal ball. The analysis criteria are becoming stricter and the views more critical, from investors and financiers. The importance of the commercial appraisal is increasing and a CDD is becoming necessary where none may have been required before covid.

For more than 20 years, maconda has partnered in the acquisition, further development and restructuring of companies. We also support our clients strategically and operationally in the digitalisation of their value creation, their products, their processes as well as the complete business model, beyond individual actions and buzz words. We have carried out over 800 consulting and implementation projects, including more than 450 transaction-related mandates. Our clients are primarily medium-sized companies as well as international private equity investors and family offices.

We are one of the most experienced commercial due diligence advisors in the German-speaking world. This creates a basis for an equally fast and precise assessment of opportunities and risks – in CDD audits as well as in (subsequent) value enhancement projects.

maconda focus industries: Consumer Goods | Food | Apparel & Textiles | Retail & eCommerce | Packaging | B2C Services | B2B Services (incl. Business Process Outsourcing) | Future Technologies & Software | Manufacturing Companies | Healthcare & MedTech